Content

- TAX ID

- Blueprint for Financial Success

- Own a Business or Self Employed? Get your tax money back!

- University of Central Florida

- Portland State University

- No matter how complex or ugly your tax situation seems, Kuberneo CPA can help resolve it.

- Financial Modelling In Excel 2 Days Training in Orlando, FL

- Meet Our Forensic Experts

A large reason why organizations choose Withum is that we are deeply rooted in our community and put world-class client service at the heart of what we do – it’s the Withum Way. With a depth of resources and a high level of expertise, our Orlando specialists provide insurance claim evaluations, fraud and financial investigations, and more. Growing your business without a road-map can bring difficulties, inefficiencies and personnel challenges.

They often work closely with law enforcement and lawyers, and they can help determine the legality of financial activities, according to the BLS. We work with entrepreneurs and startups who need growth support to help you take your business to the next level. Tax planning strategies to minimize your tax obligation and keep more money in your pocket. Our payroll processing is done accurately, and efficiently, making sure our clients are in compliance with payroll regulations.

TAX ID

Our office is in the heart of the city’s central business district, highlighting the Firm’s bold and innovative mindset and serving as a base for more than 110 team members. Website development for accountants designed by Build Your Firm, providers of accounting marketing services. We offer wealth management, estate planning, financial consultation, and much more. Pat Baggett – Patrick Baggett began his career as an auditor for the Florida

Department of Revenue. He has over twenty years of experience as a controller and tax director in private industry with an emphasis on state and local tax issues including sales and use tax.

I truly love having a partner on the book keeping and accounting side of the house that is flexible … Digital form to contract the Extension of deadline service for the delivery of your taxes. Wesco International, Inc., including its subsidiaries and affiliates (“Wesco”) provides equal employment opportunities to all employees and applicants for employment. Employment decisions are made without regard to race, religion, color, national or ethnic origin, sex, sexual orientation, gender identity or expression, age, disability, or other characteristics protected by law. US applicants only, we are an Equal Opportunity and Affirmative Action Employer.

Blueprint for Financial Success

With a focus on Healthcare, Hospitality, Not-for-Profit, Technology, Manufacturing, and Construction, our client list expands across all industries. The cornerstone of our region is a thriving, connected business community https://www.bookstime.com/ that supports one another and comes together in times of need. As a result, you’ll find Withum sponsoring, volunteering and giving back to many not-for-profit organizations and events in Central Florida.

Everyone in our organization, accountants, bookkeepers, consultants, tax personnel, and support staff becomes a part of your team when you become a client of our firm. We work for you on a monthly basis to review your results, help you make more money, save on taxes, and plan for your future success. Matt Spires – Matt graduated from Wright State University in Dayton, Ohio with a Bachelor of Science in Business Administration, majoring in Accounting. 15 years of public accounting experience in providing auditing and tax services. His clients have included not-for-profit, construction and various other organizations operating in a variety of industries.

Own a Business or Self Employed? Get your tax money back!

We can provide all or part of your accounting services at your place of business or on the web so that your financial records are always in order. With over 13 year of experience, Rose has been performing a variety of professional accounting functions from payroll and sales tax to preparations of financial statements. As a QuickBooks ProAdvisor, she also consults with clients helping them with account set up and clean-up. Since joining our firm, Rose has gained extensive knowledge in preparing corporate and individual tax returns.

She specializes in QuickBooks, but also has experience

with other general ledger programs. Steve Sheridan, CPA – Steve joined one of STWMS ‘s predecessor firms, Schafer, Mitchell and Sheridan PA in January 1996. His public accounting experience has focused primarily on tax and accounting issues for Agriculture, Real Estate and Manufacturing entities. Tom Whitcomb – Tom graduated from Brigham Young University with a Bachelor of Science degree in accounting.

University of Central Florida

In an increasingly small world, Baldwin bridges the gap between nations by offering a range of international tax and accounting services. Performed in line with international standards, our work assures the financial integrity of international real estate transactions, multinational business dealings, and business and individual tax preparation. Grennan Fender, LLP has been a leading Orlando CPA and business financial solutions firm for more than 40 years. Our company provides a wide array of innovative services for clients, including tax, audit, consulting, outsourced accounting, cloud accounting and tax planning to meet both individual and business needs. Watch our video below to learn how Grennan Fender can help your business succeed. With a package of available services that includes tax preparation, audits, short and long term business planning, virtual bookkeeping and oversight services and more, we help support your company’s financial needs.

Joe also has intimate experience with non-profit organizations and affiliate business enterprises. Accountants may offer a package rate for weekly, monthly or annual services to reward ongoing customers. For basic monthly accounting services, an accountant might charge anywhere from $75 to $500 or more, depending on what was included in a given package, the size of the client’s business, and the complexity of work requested. Nationally, full-time staff accountants earn between $40,000 and $80,000, depending on experience and other factors.

Portland State University

Ballantyne Accounting has been serving clients of Orlando, Fla., and the surrounding areas with years of industry experience and knowledge. Our accounting services include tax return preparation, bookkeeping and electronic filing services. Whether you’re looking to file your tax return, put your financial goals in action, or plan your estate, Baldwin Accounting CPA knows tax law and how to apply it in your favor. Unlike seasonal tax services, we work with taxes and financial reports all year long, so we can offer you commitment and in-depth knowledge in addition to basic services. Kuberneo CPA is an accounting firm in Orlando offering small and medium-size businesses the experience, knowledge and insight they need to make better decisions to meet financial, operations and accounting objectives.

- You will analyze current costs, revenues, financial commitments, and obligations incurred to predict future revenues and expenses.

- While in college he interned with the Internal Revenue Service at the District office in Jacksonville, Florida.

- Tom Tschopp – Tom earned a Bachelor of Science degree in Accounting from the University of Florida.

- Ballantyne Accounting has been serving clients of Orlando, Fla., and the surrounding areas with years of industry experience and knowledge.

- We have a very professional, personal approach designed to provide the best service at the most reasonable rates.

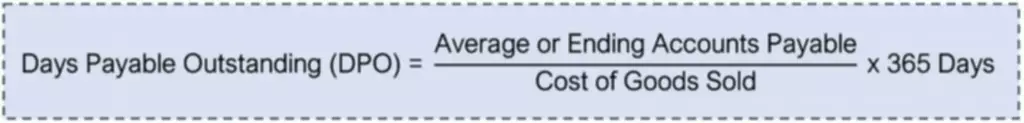

Accounts Payable monitors and processes cash disbursements, credit card disbursements, employee education and travel reimbursement, and ensures compliance with city policies and procedures. You can also ask an accountant to provide proof of their license and credentials. Please Bookkeeping Services in Orlando visit our resources page to learn what you should bring to your first tax appointment. Sign in to create your job alert for Accountant jobs in Orlando, Florida, United States. Click the link in the email we sent to to verify your email address and activate your job alert.

According to the American Institute of CPAs, certified public accountant (CPAs) financially advise individuals, big companies and small businesses to help them reach their financial goals. He has extensive experience in the area of the Low Income Housing Tax Credit

(LIHTC) program. Whether it’s litigation support or thorough fraud and forensic services, Meaden & Moore’s forensic accountants in Orlando can provide investigative accounting and consulting solutions that increase your company’s bottom line. Our Orlando office is particularly active in catastrophe services, working on claims resulting from the many natural disasters that have occurred in the Southeast recently. Running a business is as enjoyable as it is challenging and Kuberneo CPA knows that. Our staff has seen it all—from those nasty IRS letters threatening to levy your assets to complex situations such as multi-state tax filings or high-net worth estate accounting.

And if that’s not enough, our accounting firm in Orlando even offers forensic accounting services to help you prevent employee fraud, theft of misappropriation of funds. Our firm is dedicated to providing accounting, tax, and consulting services to both businesses and individuals in the Orlando area. We offer a free initial consultation to get to know new clients and discuss their accounting and tax needs.