Another aspect to be considered is the similarity in business models and company size. A large and settled one will likely experience less volatility in their earnings than a small/mid company. So try to match as much as possible competitors, considering, for example, the level of revenues. In short, it indicates the level of safety that a company has for debt interest repayment.

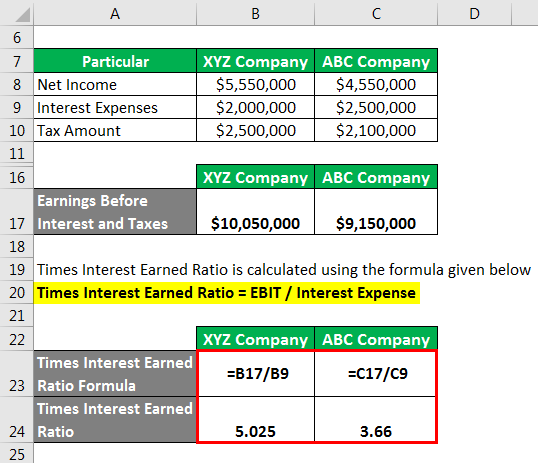

Interest expense example and time interest earned ratio derivation

A TIE ratio of less than 1 indicates that the company is not generating enough earnings to cover its interest expenses, which could be a red flag for investors. Conversely, a TIE ratio above 2 is generally considered healthy, suggesting that the company can comfortably meet its interest classifying liabilities as current or non obligations. In that case, it means the company is not generating enough to pay the interest on its loans and might have to dig into the cash reserves, affecting company liquidity. EBIT is calculated by subtracting operating expenses from total revenues, excluding interest and taxes.

Formula To Calculate Times Interest Earned Ratio (TIE) :

Based on the times interest earned formula, Hold the Mustard has a TIE ratio of 80, which is well above acceptable. As we previously discussed, there is a lot more than this basic equation that goes into a lender’s decision. But you are on top of your current debts and their respective interest rates, and this will absolutely play into the lender’s decision process. While this ratio does show you how much of a company’s leftover earnings are available to pay down the principal on any loans, it also assumes that a firm has no mandatory principal payments to make. The EBIT figure for the time interest earned ratio represents a firm’s average cash flow, and is basically its net income amount, with all of the taxes and interest expenses added back in.

Company

The Times Interest Earned (TIE) Ratio is a financial metric used to evaluate a company’s ability to meet its debt obligations. It measures how many times a company can cover its interest expenses with its earnings before interest and taxes (EBIT). This ratio is crucial for creditors and investors as it provides insight into the company’s financial stability and risk level. Our Times Interest Earned Ratio Calculator simplifies the calculation process, helping you assess your company’s capacity to meet interest payments efficiently.

Interpretation & Analysis

- Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

- This is a measure of how well a firm can cover interest costs with its earnings.

- With it, you can not only track when a company is earning more money than the interest it has to pay but also when the earnings are getting worse and the risk of credit default is increasing.

- Startup firms and businesses that have inconsistent earnings, on the other hand, raise most or all of the capital they use by issuing stock.

The times interest earned ratio shows how many times a company can pay off its debt charges with its earnings. If a company has a ratio between 0.90 and 1, it means that its earnings are not able to pay off its debt and that its earnings are less than its interest expenses. To have a detailed view of your company’s total interest expense, here are other metrics to consider apart from times interest earned ratio.

Rule of 72 Calculator – Calculate Compound Interest

This metric, also known as the interest coverage ratio, provides insight into how easily a firm can pay the interest on its outstanding debt. Investors consider it one of the most critical debt ratio and profitability ratios because it can help you determine if a company is likely to go bankrupt beforehand. Calculating the Times Interest Earned Ratio is crucial for assessing a company’s ability to cover its interest payments with its earnings. This financial metric offers insights into a company’s financial health and creditworthiness. Our Times Interest Earned Ratio Calculator simplifies this calculation for you. The times interest earned (TIE) ratio is a financial metric that measures a company’s ability to fulfill its interest obligations on outstanding debt.

You can now use this information and the TIE formula provided above to calculate Company W’s time interest earned ratio. EBIT is used primarily because it gives a more accurate picture of the revenues that are available to fund a company’s interest payments. Welcome to our Times Interest Earned Ratio Calculator – Your tool for assessing financial stability. Input EBIT (Earnings Before Interest and Taxes) and Interest Expense, and our calculator will help you estimate the Times Interest Earned Ratio.

With that said, it’s easy to rack up debt from different sources without a realistic plan to pay them off. If you find yourself with a low times interest earned ratio, it should be more alarming than upsetting. This ratio determines whether you are in a position to pay the interest to the venture capitalists for fundraising with your retained earnings. Hence, it is required to find a financial ratio to link earnings before interests and taxes with the interest the company needs to pay. With it, you can not only track when a company is earning more money than the interest it has to pay but also when the earnings are getting worse and the risk of credit default is increasing. The Times Interest Earned (TIE) Ratio measures a company’s ability to meet its debt obligations by comparing its earnings before interest and taxes (EBIT) to its interest expenses.

In most cases, higher Times Interest Earned (TIE) means your company has more cash. The times interest earned ratio is a calculation that allows you to examine a company’s interest payments, in order to determine how capable it is of meeting its debt obligations in a timely fashion. The different debt analysis tools, such as current ratio calculator and the quick ratio calculator, are complementary to the interest coverage ratio calculator because they show different information. The latter focuses on cash inflows and outflows rather than on current assets and current liabilities like the former one.

This number measures your revenue, taking all expenses and profits into account, before subtracting what you expect to pay in taxes and interest on your debts. As a rule of thumb, investors generally look to have at least an interest coverage ratio greater than 3. In other words, we are looking for companies that are currently earning (before paying interest and taxes) at least three times what they have to pay in interest. Is the TIE ratio the same as the debt service coverage ratio (DSCR)?